“If you wish to get rich, save what you get

A fool can earn money; but it takes a wise man to save and dispose of it to his own advantage” – Brigham Young

Financial Planning Pyramid

Now, We will move to the remaining investment options available in the market. If you haven't checkout first post then you can checkout here.

2. Post Office Schemes

This is like a savings account with a bank, except that it is held with a post office. There are various saving and FD schemes available to invest. You can get all the detail of schemes from official Post Office Saving Schemes website.

Now, You might ask a question why should we go for POS rather than bank schemes ?

Just think what if banks go bankrupt ? What about your savings ? How much you get back are the entire value or some fixed value ?

Aww..wait, Don't stand up and rush to the bank and withdraw all your savings. There is a provision for this type of crisis. In FY 2020-21 budget The Finance minister proposed an increase in insurance amount for depositors in case of bank failure, the RBI has announced an increase in insurance cover to ₹5 lakh per depositor, from ₹ ₹1 lakh.

Here are 2 things to know about this scheme:

1) All types of bank deposits including savings, fixed and recurring, are covered under the scheme. The ₹5 lakh limit covers both principal and interest amount.

2) It is to be noted that this deposit guarantee is involved only if the bank gets closed. It cannot be released if the bank is a going concern.

Now, what if your aggregated about exceed 5 lakh in particular bank? You will lose your entire capital. To be risk free in these situations I recommend every individual to maintain 1 POS account for their family becasue POS completely secure in nature as it's backed by the Government of India & it's never to get closed.

I hope you will consider this saving options and try to maintain your capital in a place where your risk is less or zero.

3. Bullion

Investment in Gold & Silver is favorite for all Indian consumer but rather than buying gold as an investment option we generally see as security in nature. Mostly we buy gold in forms of jewelry and generally not even think about selling gold unless and until there is a financial crisis.

There is a risk of theft in physical form and also if you put it in a bank locker than charges of lockers need to be considered while investing in physical gold. On the other side nowadays the government is promoting buying gold in digital form. Gold in digital form fetches same return as gold in physical form and Gold in digital helps liquidity in the economy.

Currently, Government is running an scheme of Sovereign Gold Bond (SGB) to encourage people to buy gold in digital format. SGB also fetches the additional annual retun of 2.5% on purchasing of gold bond. You can checkout all the details on NSE website here.

4. Real Estate

The Real Estate sector is one of the most internationally renowned sectors. In India, real estate is the second major sector/employer following agriculture. In the Covid pandemic situation Real Estate is the most underperformed sector amongst others. Also, Real estate sector highly unliquidated, We can't sell or buy property in a day therefore by looking current economic situation it's not advisable to invest in any real estate property.

5. Bonds/Debentures

Bonds/Debentures are a kind of debt instrument where the issuer (Govt agencies & Companies) of the bond has taken a fixed amount from a person/institute and paid the intrest at pre-define rate & principal at time of maturity. The bonds generally have some locking period typically in the range of 5-10 years. This lock in period is also known as the maturity period of the bonds/debentures.

Investing in debt mutual fund consider as a safer option than equity market but there are mainly 2 risk associated with bonds/debentures.

Credit Risk

Credit risk is a measure of a borrower’s ability to repay a loan and the interest charged on that loan. There might be a chance that companies failed to pay interest and principal amount to the bondholders. In that case, before issuing any debt instrument to the public there has to be a credit risk rating for the bonds/debentures. A high rating means there are very few chances of default on payment or vice versa.

Interest Risk

A Interest risk is a risk associated with the interest rates changes of any economy. If intrest rates are lower then respectively value of olders bonds are goes higher because whichever new bonds will assign in future that interest rate is lower than the previous. If interest rates are higher in economy then older bonds value is decrease compared to the new bonds.Mainly people will invest in debt instrument via debt Mutual Fund. There are many types of debt funds including corporate bond, liquid bond, overnight bond , short duration bond, long term bond. You can checkout all the debt & equity mutual funds avaialble from Groww application/website.

5. Equity (Shares)

An equity market or share market is a market where shares(very small part) are issued and traded, It is one of the most vital areas of a market economy because it gives companies access to capital and investors a slice of ownership in a company with the potential to realize gains based on its future performance. A companies shares can be through exchanges and it can be hold in a demate account. A person can open a demate account with any brokers associated with exchanges. I personally prefer to have an account with Zerodha & Upstox.

Equity market will give you high returns if an investment made upon certain parameters while managing the risk.

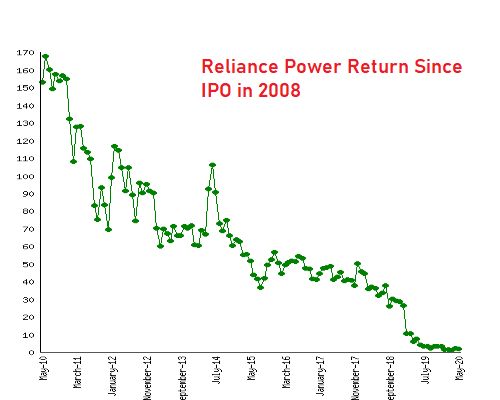

Reliance got listed on stock exchange in 1977. 10,000 Rs invested in reliance at the time of IPO now it become more than 2,10,00,000. while on the other side 10,000 Rs invested in Reliance power IPO in 2008 got vanished and just left with 4 Rs. So before investing in equity market an in depth study required or a person can invest through mutual fund.

5. Mutual Fund

A mutual fund is a type of financial vehicle made up of a pool of money collected from many investors to invest in securities like stocks, bonds, money market instruments, and other assets. Mutual funds are operated by professional money managers, who allocate the fund's assets and attempt to produce capital gains or income for the fund's investors. A mutual fund's portfolio is structured and maintained to match the investment objectives stated in its prospectus. There is a best curated blog on mutual fund topic by Zerodha varsity you can checkout here.

Now, that we have learned the various investment instrument In coming blogs, We will explore the area of Insurance, How it plays a major role in your financial Independence till then "STAY SAFE".✌️😀